What is the 50-30-20 Rule?

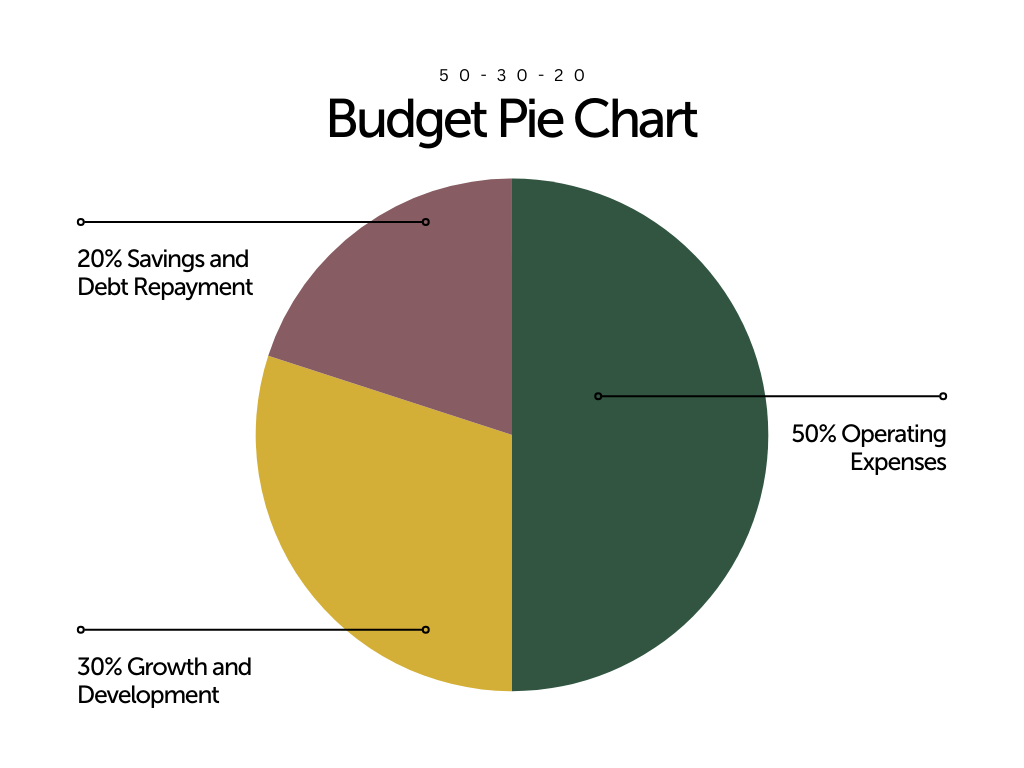

The 50-30-20 rule divides your business income into three categories:

- 50% for Operating Expenses

- 30% for Growth and Development

- 20% for Savings and Debt Repayment

50% for Operating Expenses

Operating expenses include all the essential costs required to keep your business running. This can include rent, utilities, payroll, inventory, and other day-to-day expenses. Allocating half of your revenue to these expenses ensures that your business can maintain its operations smoothly.

30% for Growth and Development

Investing in the growth and development of your business is crucial for long-term success. This category covers marketing, research and development, technology upgrades, and employee training. By dedicating 30% of your income to growth, you ensure that your business continues to evolve and stay competitive in the market.

20% for Savings and Debt Repayment

Setting aside 20% of your revenue for savings and debt repayment is essential for financial security. This includes creating an emergency fund, saving for future investments, and paying off any business loans or credit card debt. Having a safety net helps your business withstand unforeseen challenges and provides the capital needed for future opportunities.

Implementing the 50-30-20 Rule

- Assess Your Finances: Start by analyzing your current income and expenses. Categorize each expense to understand where your money is going.

- Set Clear Goals: Define your business goals for growth and savings. Having clear objectives helps in making informed decisions.

- Monitor and Adjust: Regularly review your budget and financial statements. Adjust your allocations as needed to align with your business needs and market conditions.

The 50-30-20 rule offers a straightforward and effective framework for managing small business finances. By allocating funds strategically, you can ensure that your business not only survives, but thrives in this economic climate. Regular monitoring and flexibility are key to adapting this rule to the unique needs of your business. Embrace the 50-30-20 rule and take control of your financial future, one balanced budget at a time.